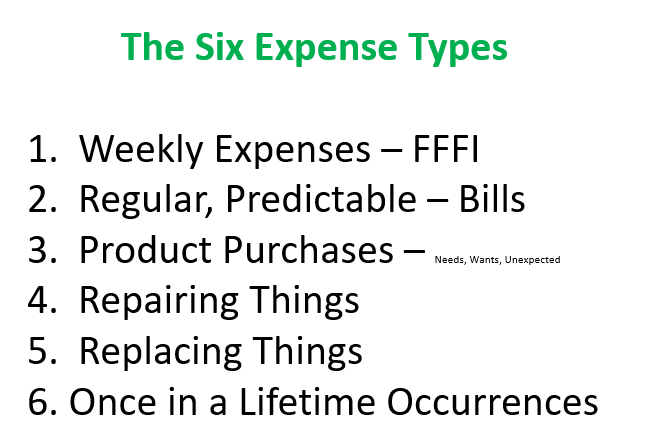

FFFI means FOOD, FUEL, FUN, INCIDENTALS.

2nd of 6 EXPENSE TYPESNon-Weekly Repeating Predictable Expenses - (otherwise known as 'Bills')This will be your primary bank account where all your finances originate from.These fall into two groups:- Group ONE:

Rent, Electricity, Telephone, Rates, Insurance, Planned Gifts, Regular Donations, Vehicle Registration, Memberships, Children's Lessons, Dentist, Gifts, Education, and other similar expenses.I enter ALL expenses in the BILLS account, except for those of course in the FFFI.- Group TWO:

Mortgage(s) and / or Loan RepaymentsThese are payments or expenses you can reasonably predict into the future:You know how much they usually cost with reasonable accuracy, or, if you don't know how much they usually cost, you can nominate an amount that will work for you.You know how often they fall due within a yearly cycleYou know when they will occur nextIf you do not know these three facts about an expense it does not belong in this list.

3rd of 6 EXPENSE TYPESThese fall into two groups.Group ONE:Things You Need. For example - White Goods, Motor Vehicles, FurnitureGroup TWO:Things You Want. For example - Hobbies, Clothing, Travel, RecreationalWhere To keep This Money

Because these expenses tend to be less frequent and less predictable, you could easily spend more than you can afford on these items if you have no plan. Therefore, you should have a separate account that is dedicated to these expenses. You might even consider having multiple accounts for different goals, hobbies or desires so that you can easily identify how much you have available for each one.

4th of 6 EXPENSE TYPESooner or later you will have to pay for repairs to something you rely on. For example - White Goods, Motor Vehicles, your body, etc.Many people believe that the seemingly untimely need to repair something they rely on every day was an unfortunate unpredictable event.However, everything breaks down sooner or later, so it is important to put funds aside in anticipation of this.Be prepared for the unplanned and unexpected by creating a proven Spending Plan.

5th of 6 EXPENSE TYPESThis group contains items you rely on in living your life. This would also include replacing items that you have just for fun if you can afford to include them. Examples - White Goods, Motor Vehicles, Furniture, ComputerWant to learn where to keep and how to manage this fund or money?The Spending Planner (software) will easily show you how to save for these type of expenses.Think long term for financial peace!

6th of 6 EXPENSE TYPES

These also fall into two groups:

Group ONE:

Larger Life Goals: These are bigger events you want to make happen, and you have a time frame in mind. For example, retirement, an overseas holiday, big dreams and desires.

Group TWO:

Unpredictable larger expenses: These are expenses that you don't really know when or even if they will occur, but you need to be prepared for them just in case. For example, a major car repair bill, a child's future university education, a medical emergency, a child's wedding, and similar.

Where To Keep This Money

Talk to a financial planner for investment/retirement advice. Your Spending Planner may be able to connect you with someone if you do not have one.

For other big goals that do not fall under the retirement or investment banner use our spending plan to plan and track this money by setting up separate accounts under your savings list. This will keep this money easily identifiable.

Time to get our head-out-of-the-sand and be honest with ALL the six (6) ways YOU spend money. Then create a plan (Spending Plan) to be prepared for all these expenses.

The Spending Planner (software) goes beyond budgeting. Adding the missing dimension of TIMING!

Want to learn how to organize and manage the six expense types?

The ANSWER is creating a Spending Plan in the Spending Planner software.