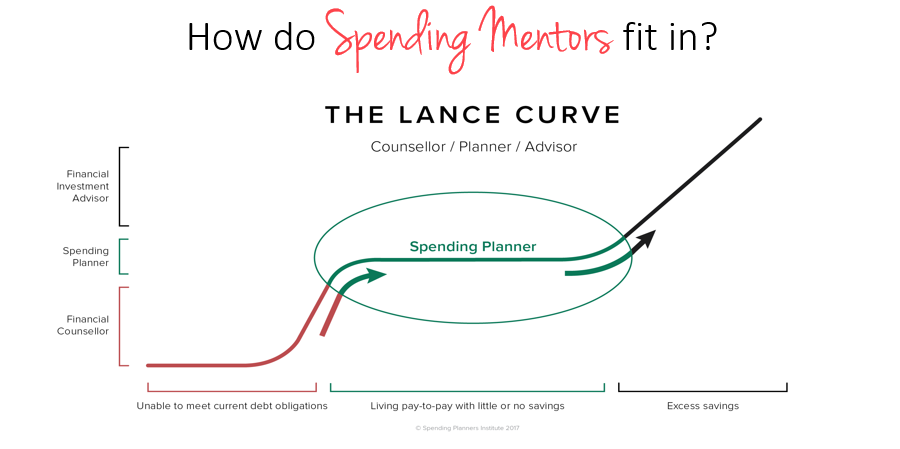

Spending Planning is a new industry born out of a critical need to bridge the gap between Financial Counselling and Financial Planning that specialises in providing a way forward for millions of middle income families and individuals who are feeling a real sense of frustration due to day-to-day money stress.

Based on the simple premise that people who are having difficulty making positive progress with their money goals, who feel like they are going round in circles and are stuck on a financial treadmill, will quickly find direction and a sense of relief once they are given the correct tools, training, guidance and mentoring that has never been available up until now.

Spending Planners are trained to help everyday people get off that treadmill, leave the money stress behind and start experiencing a much more gratifying lifestyle that is NOT dominated by financial pressures.

Paying down debt and accumulating a savings buffer can happen much faster than you ever thought possible when you have a Spending Planner on your team.

Spending Planners complement the existing financial services industries and help their clients build a solid financial foundation for other service providers to build on. They do this by showing their clients why their previous attempts at budgeting have failed them and teaching them how to create a Spending Plan that actually works. The video will help you understand this: